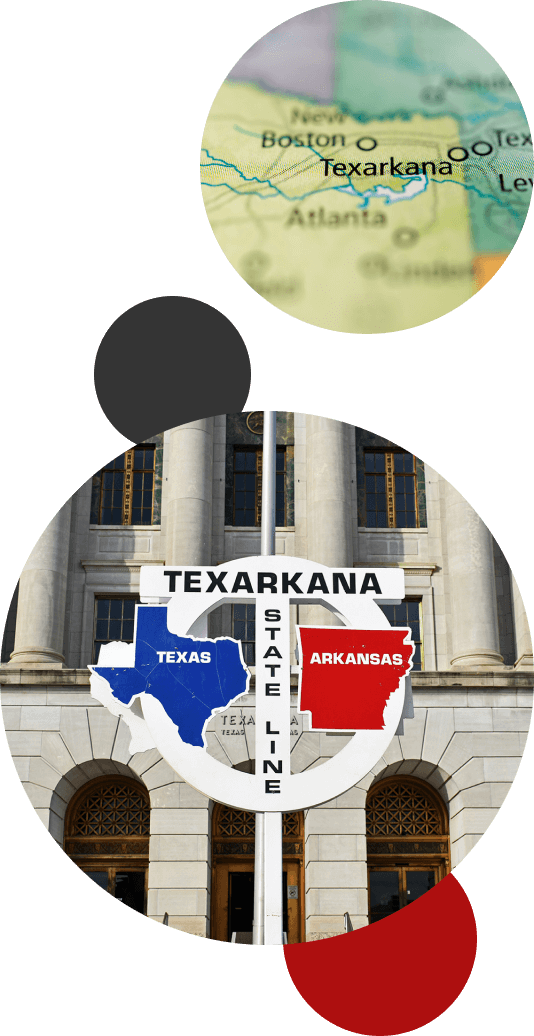

Your Trusted Mortgage Partner in Texarkana, TX

Welcome to Mortgage Financial Services, your premier mortgage company in Texarkana, Texas. We’re here to turn your homeownership dreams into reality.

Why Choose Mortgage Financial Services?

At Mortgage Financial Services, we understand that buying a home is one of the most significant decisions you’ll make. As a leading mortgage provider in Texas, consistently ranked in the top 10% of lenders by customer satisfaction, we’re committed to providing exceptional service and tailored solutions to meet your unique needs.

Our local expertise, combined with our national presence, sets us apart. We serve Texarkana and surrounding areas, with licenses in 11 states, including Texas and Arkansas (NMLS ID 43021). This broad reach allows us to offer diverse mortgage products while maintaining a deep understanding of the local Texarkana market.

We promise personalized service, competitive rates and terms, and expert guidance throughout the home loan process. Our team stays current with industry trends and regulations to ensure you receive the most beneficial advice.

Local Expertise

As a local mortgage company in Texarkana, we have in-depth knowledge of the area’s real estate market.

This local insight allows us to offer tailored advice and find the best mortgage solutions for your unique situation. We stay up-to-date on local market trends, property values and neighborhood developments to ensure you make informed decisions.

Personalized Service

At Mortgage Financial Services, you’re not just another customer. We take the time to understand your goals and financial situation, ensuring you get the right mortgage for your needs. Our dedicated loan officers will guide you through every step of the process, from application to closing, providing clear explanations and prompt responses to your questions.

Wide Range of Loan Options

From first-time homebuyers to seasoned investors, we offer loan products to suit every need. Our diverse portfolio includes:

- Conventional loans for those with strong credit

- FHA loans for buyers with less-than-perfect credit

- VA loans exclusively for eligible veterans and active-duty military

- USDA loans designed for rural and suburban homebuyers

- Jumbo loans for high-value properties

- Refinancing options to help you tap into your home’s equity

Our team will guide you through these options to find the perfect fit for your financial goals.

Why Choose Mortgage Financial Services in Texarkana, TX?

We offer comprehensive mortgage services tailored to the Texarkana market:

Home Purchase

Loans:

Refinancing Your

Loans:

Lower your monthly payments, reduce your interest rate or tap into your home’s equity with our refinancing options. We’ll analyze your current mortgage and financial situation to determine if refinancing is the right move for you.

Investment Property Loans:

Looking to expand your real estate portfolio? We can help you secure financing for your investment properties. Our experts understand the unique requirements of investment property loans and can help you maximize your returns.

Down Payment Assistance:

Our Services

Ready to take the first step toward homeownership in Texarkana? Here’s how to get started:

First-Time Home Buyers

Embarking on your homeownership journey can be daunting, but our team specializes in guiding first-time buyers through each step. We’ll explain the process clearly, help you understand your budget, and find loan options that best suit your situation. Our goal is to make your first home purchase smooth and enjoyable.

As a first-time homebuyer, you may be eligible for special programs and incentives. We’ll help you explore these options to maximize your benefits, potentially saving you thousands on your home purchase.

Down Payment Assistance

Don’t let a down payment hold you back from homeownership. We offer various programs to help overcome this common hurdle, including grants, low-interest loans, and matched savings programs. Our experts will help you navigate these options and find the best fit for your financial situation.

Refinancing Options

Looking to lower your monthly payments, shorten your loan term, or tap into your home’s equity? Our refinancing options could be the solution. We’ll analyze your current mortgage and financial goals to determine if refinancing could benefit you. Whether it’s a rate-and-term refinance or a cash-out option, we’ll guide you through the process.

Refinancing can potentially save you thousands over the life of your loan. We’ll help you determine if it’s the right move for your financial situation, considering factors like current interest rates, your credit score, and your long-term financial goals.

Investment Properties

Ready to expand your real estate portfolio? We have tailored mortgage solutions for investment properties. Our team understands the unique challenges and opportunities in real estate investing. We’ll help you structure your loan to maximize your investment potential while minimizing risk.

The Mortgage Financial Services Advantage

In-House Down Payment Assistance

Our dedicated Dream Team provides in-house down payment assistance, streamlining your entire home loan process under one roof. This integrated approach saves you time and reduces stress, as you won’t need to coordinate with multiple entities to secure your financing.

Personal Financial Planning

Work one-on-one with our financial experts who will guide you through every aspect of your mortgage journey. We take a holistic approach, considering not just your immediate home purchase but your long-term financial goals as well. Our advisors can help you understand how your mortgage fits into your overall financial picture.

Award-Winning Service

Our commitment to customer and employee satisfaction has earned us recognition as one of the:

These accolades reflect our dedication to both clients and employees, ensuring a positive experience for everyone involved in the mortgage process. Our award-winning service means you can trust us to provide expert guidance, transparent communication, and a smooth lending process from start to finish.

Why Texarkana Homebuyers Trust Us

Local Knowledge:

We understand the Texarkana housing market, including neighborhood trends and property values. Whether you’re looking for historic charm, family-friendly atmosphere or something different altogether, we can guide you through the local real estate landscape.

Diverse Loan Options:

We offer a wide range of mortgage products to suit every need, from conventional loans to specialized programs.

Personalized Service:

Your dedicated loan officer will guide you through the entire process, from application to closing and beyond.

Transparency:

We believe in clear communication and no hidden fees. You’ll always know exactly where you stand in the mortgage process.

Quick Approvals:

Our streamlined process gets you into your new home faster, without compromising quality. We leverage technology to expedite paperwork while maintaining a personal touch.

Frequently Asked Questions About Buying a Home

Am I eligible for a mortgage if I have a low credit score?

We work with various lenders and offer multiple loan programs. Even with a low credit score, we may have options for you. We’ll review your overall financial situation and explore programs designed for borrowers with less-than-perfect credit.

How much down payment do I need?

Down payment requirements vary by loan type. Some programs offer as low as 3% down, and we have assistance programs that can help. We’ll work with you to find a solution that fits your financial situation.

How long does the mortgage process take?

The timeline typically ranges from 30 to 45 days from application to closing. We strive to make the process efficient. Our team will keep you informed at every stage and work diligently to ensure a timely closing.

Can I get pre-approved for a mortgage?

Absolutely! We encourage pre-approval as it gives you a clear picture of your budget and strengthens your position when making an offer. Pre-approval involves a thorough review of your finances and can give you a significant advantage in a competitive housing market.